Excess Inventory Management: Key Takeaways

- It’s not just about finding room on the shelves; excess inventory quietly eats into your cash flow, racks up storage fees, and risks turning useful parts into dead weight

- Common causes include poor demand forecasting, supplier minimums, and product lifecycle changes, all of which can be addressed with better planning and visibility tools

- Strategic solutions range from resale and consignment programs to internal repurposing and bill of materials alignment, helping OEMs recover cost and space

- Digital inventory optimization tools and lifecycle tracking can help manufacturers avoid future overstock and respond faster to demand shifts

- AGS Devices offers full-lot buyouts, consignment programs, and verified buyer networks, helping OEMs turn excess into a revenue-generating asset

In manufacturing, excess inventory isn’t just a warehousing issue, it’s a strategic liability.

Up to 30% of working capital is often tied up in unsold or slow-moving inventory, putting pressure on cash flow, storage costs, and operational agility.

You’ve seen it before when someone commits to a big order based on an early forecast, then a mid-cycle change hits, and boom, now you’re stuck with thousands in unusable stock.

The good news? With the right strategies and resale pathways in place, overstock doesn’t have to be a sunk cost; it can be turned into liquidity, supply chain resilience, and long-term operational efficiency.

In this guide, we’ll cover:

- What excess inventory is and how it impacts OEM operations

- Common reasons manufacturers end up overstocked

- Proven strategies to reduce and repurpose excess stock

- Smart selling solutions for surplus components

Understanding Excess Inventory and Its Impact

Even for the most efficient OEMs and manufacturers, excess inventory can quietly erode margins and slow down operations.

How It Affects You Bottom Line

- Ties up cash that could be used for active production or new sourcing

- Increases storage costs, insurance, and handling overhead

- Raises the risk of obsolescence and expired shelf life

- Leads to markdowns or scrap losses if not addressed early

Operational Drawbacks

- Disrupts accurate demand forecasting and procurement alignment

- Reduces flexibility to pivot toward urgent builds or innovation

- Skews production planning, causing mismatches between supply and real-time needs

- Crowds warehouse space, limiting storage for fast-moving or high-priority stock

When left unmanaged, excess inventory isn’t just “extra stock”, it’s a slow-moving operational risk. But with the right strategy, it can be turned into a valuable recovery opportunity.

Common Causes of Overstock in Manufacturing

Overstock is often the result of good intentions colliding with unpredictable variables. From forecasting misfires to internal misalignments, manufacturers end up with more inventory than they can use or afford to store.

Forecasting Errors and Siloed Planning

It all starts at the planning stage, when demand predictions miss the mark or communication breaks down across departments.

Here’s where it tends to go wrong:

- Teams rely on static forecasts instead of real-time demand signals

- Sales and operations don’t align on updated inventory needs

- Safety stock thresholds are increased without evaluating true consumption

Market Shifts That Catch You Off Guard

Customer behavior, regulations, and product requirements can shift quickly, and excess inventory often piles up before teams can pivot.

This usually breaks down when:

- Products get discontinued or delayed after large electronic component orders are placed

- Regulatory changes make some stocked parts obsolete or non-compliant

- Customer preferences shift to new models, leaving older inventory idle

Disconnect Between Procurement and Production

Even when the purchase goes as planned, disruptions on the production floor can stall material usage.

The disconnect usually shows up when:

- Parts are delivered long before machines or lines are ready

- Production changes reprioritize what gets built and when

- Engineering teams modify specs after stock has already arrived

Last-Minute Engineering Changes

And then come the last-minute design changes, new specs get signed off, and suddenly half your inventory doesn’t fit the build.

Common slip-ups at this stage include:

- New components are approved mid-cycle, rendering older ones redundant

- Slight spec changes (voltage, tolerance, form factor) disqualify stock already on shelves

- Alternate parts previously accepted get rejected after new revisions

BOM misalignment is one of the top culprits behind excess inventory. For a deeper breakdown of how BOM strategy affects inventory outcomes, check out our article on BOM inventory management.

Strategies To Reduce and Manage Excess Inventory

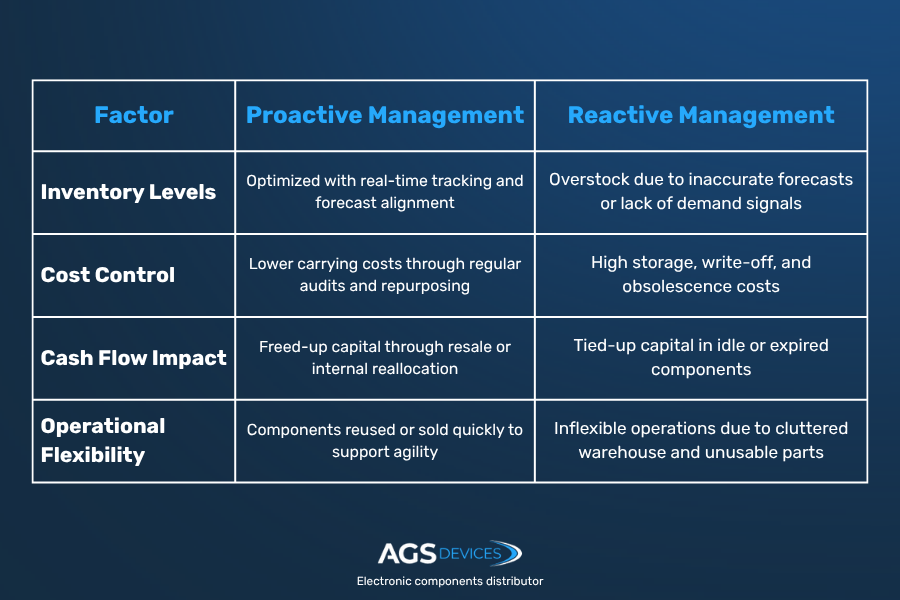

Controlling inventory isn’t just about reacting to overstock, it’s about preventing it in the first place. Below is a flexible, hands-on list of strategies OEMs and manufacturers can use to stay lean while maintaining production readiness.

Tactical ways to reduce and control overstock:

- Recognize parts that haven’t moved in months, as they’re already costing you

- Adjust purchasing frequency based on rolling usage data, not just static forecasts

- Work with suppliers to split MOQ deliveries or use vendor-managed inventory programs

- Standardize components across SKUs to increase repurposing options

- Implement FIFO (first-in, first-out) systems to reduce aging or expired parts

- Reallocate unused components between facilities or product lines where possible

- Use data from BOM audits to flag over-ordered or duplicate part numbers

Excess inventory inflates your total BOM cost, especially when unused components linger across multiple production cycles. Learn more about cost control in our guide to BOM cost calculation.

Strategic improvements that support leaner inventory over time:

- Set up alerts for inventory aging beyond 90 days, which is a common early sign of overstock

- Map demand variability by product category and align safety stock accordingly

- Combine sourcing flexibility (i.e., alternates) with agile procurement planning

- Invest in inventory optimization tools that integrate with MRP/ERP systems

- The right BOM management software can help you forecast better, reduce surplus, and align sourcing with real demand

Quick tip: If a part hasn’t moved in two full production cycles and isn’t planned for the next one, it may be time to resell or reclassify it as non-essential stock.

How To Sell or Repurpose Excess Stock

When you’re holding more inventory than your operation needs, every extra pallet is tied-up capital and wasted space. Selling or repurposing excess stock is one of the most direct ways to turn those idle assets into working capital, but only if handled strategically.

Whether you’re clearing shelf space or avoiding obsolescence, here are the most effective routes:

Sell to a Verified Electronics Reseller

This is the fastest way to free up cash and get unused parts off your balance sheet.

- Submit a detailed list of your excess components for evaluation

- Work with buyers who provide inspection, logistics support, and traceability

- Prioritize factory-sealed, static-safe components for the highest resale value

- AGS Devices, for instance, offers fast turnarounds, global resale networks, and fair market pricing

Repurpose Internally for Other Builds

Some excess stock may be usable for alternate designs, field repair kits, or in-house R&D.

- Audit compatibility with upcoming projects or lower-tier production lines

- Cross-reference BOMs to check form-fit-function matches

- Extend usability with updated documentation or revision labels

- This helps reduce fresh procurement and maximizes what’s already on hand

Use Consignment or Asset Recovery Programs

When you don’t need fast liquidation, consignment can offer a higher long-term return.

- Your stock is listed and stored with a resale partner

- You retain ownership until items sell, then receive payment minus commission

- Ideal for slower-moving, high-value parts that require the right buyer

- Can be bundled with full inventory audits and logistics handling

Why Work With AGS Devices To Manage Excess Inventory?

Excess inventory doesn’t have to be a burden on your bottom line. With the right strategy and the right partner, it can become a source of recovered capital, optimized space, and improved supply chain performance.

At AGS Devices, we help OEMs and manufacturers turn surplus into opportunity through tailored, transparent solutions designed for speed, accuracy, and value.

Here’s what we deliver:

- Fast inventory evaluations with fair, market-driven offers

- Complete logistics handling, from pickup to packaging

- Component verification to ensure resale quality and traceability

- Multiple resale and repurposing options (bulk sales, consignment, redistribution)

- Inventory optimization support for long-term supply chain health

Need to clear shelves fast? AGS can take it all off your hands, full-lot buyouts, resale programs, and a network of real buyers ready to move.

In addition to robust excess material acquisition support, we also offer:

Excess Inventory Management: FAQs

If we still haven’t answered all of your questions about excess inventory management, here are some additional ones you still might be asking yourself.

What is excess inventory?

Excess inventory refers to unused or unsold stock that exceeds current demand or production needs. It often results from over-ordering, inaccurate forecasts, or project cancellations.

Why is excess inventory a problem for manufacturers?

Holding excessive inventory ties up working capital, takes up valuable warehouse space, increases the risk of obsolescence, and reduces overall supply chain efficiency.

What industries does AGS Devices help with excess inventory?

We work with OEMs, contract manufacturers, and supply chain teams across various industries, including electronics, automotive, aerospace, industrial equipment, and more.

How can I sell or offload my excess inventory?

That’s where AGS steps in. Whether you want it gone this week or need a longer-term play, we’ve got resale options that fit your pace of moving.

What’s the resale process like with AGS?

It’s fast and transparent. Submit your inventory, we assess it, provide a quote (typically within 1–3 days), arrange logistics, verify the parts, and issue payment.

Do you buy obsolete or EOL (end-of-life) components?

Yes, especially if they’re still relevant to legacy systems or in demand on the secondary market. We help maximize recovery value while ensuring quality and traceability.

How do I know if my excess stock is still valuable?

Factory-sealed, new-condition components with clear labeling and traceability typically retain resale value. Parts stored in static-safe packaging are even better positioned for resale.

What if I only have a small batch of excess parts?

You don’t need a warehouse full of pallets for it to matter. Even a few reels or boxes of unused components can tie up capital and take up space. AGS Devices works with both small and large lot; we’ll evaluate what you have and help you recover value, no matter the size.